Modern Axis CPA Blogs: Insights on Accounting and Taxation

Personal Tax

Corporate Tax

Wealth Planning

Accounting

Tax news

Sales Tax

Technology

Modern Axis

Corporate Tax

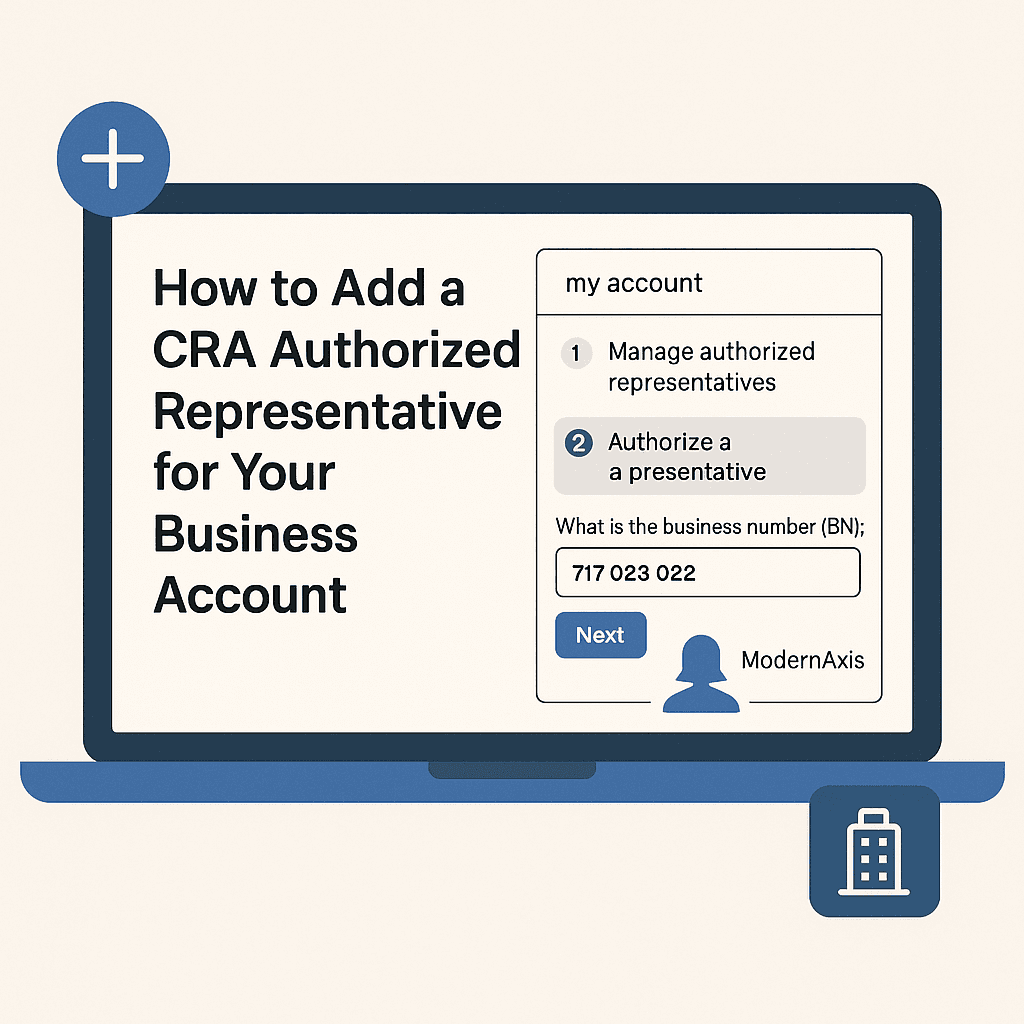

How to Add a CRA Authorized Representative for Your Business Account

Feb 1, 2026

Corporate Tax

Should You Incorporate Your Business?

Jan 25, 2026

Corporate Tax

What Are Tax Instalments in Canada?

Jan 16, 2026

Wealth Planning

The New BC Investor Playbook for Vancouver Island

Jan 14, 2026

Corporate Tax

What Is the Small Business Deduction?

Jan 4, 2026

Personal Tax

Personal Income Tax in Canada: Guide to Income and Deductions

Dec 15, 2025

US Tax

Understanding FBAR

Oct 16, 2025

Corporate Tax

CRA Voluntary Disclosures Program (VDP)

Oct 8, 2025

US Tax

Streamlined Filing for US Taxes

Sep 20, 2025

Modern Axis

CPA vs. Non-CPA: Why Choosing a Chartered Professional Accountant Counts

Sep 19, 2025

Personal Tax

5 Legal Income Splitting Strategies in Canada to Save Tax

Aug 24, 2025

Corporate Tax

Associated Corporations

Aug 23, 2025

Corporate Tax

Related Persons

Aug 4, 2025

US Tax

Understanding the Bona Fide Residence Test

Jul 11, 2025

US Tax

Understanding the Physical Presence Test

Jul 10, 2025

US Tax

US Tax Obligations for Americans Abroad

Jul 6, 2025

US Tax

U.S. Cross-Border Tax Services for Individuals

Jun 29, 2025

Wealth Planning

Lifetime Capital Gains Exemption

Jun 27, 2025

Wealth Planning

Why Family Trusts Still Matter: Legacy, Tax Efficiency & Asset Control

Jun 22, 2025

Tax News

CRA Stopping Paper Mail for Businesses in 2025

Jun 11, 2025

Modern Axis

Modern Axis Accounting: Redefining Accounting, Tax and beyond in Victoria, British Columbia

Jun 11, 2025

Sales Tax

GST on Short-Term Rental Property Sales and Change of Use

Apr 12, 2025

Corporate Tax

Holding Companies in Canada: Tax Benefits & When You Need One

Mar 8, 2025

Corporate Tax

Salary vs. Dividends: How to Pay Yourself as a Business Owner?

Mar 8, 2025

Personal Tax

Tax Considerations for Immigrants

Feb 28, 2025

Personal Tax

Understanding Tax Residency in Canada:

Feb 28, 2025

Personal Tax

Allowable Rental Expenses in Canada

Feb 16, 2025

Personal Tax

Can You Claim a Non-Resident Spouse as a Dependant in Canada?

Feb 16, 2025

Business Accounting

Bookkeeping Basics for Small Business Owners: How to Stay Organized and Help Your Accountant

Feb 5, 2025

Tax News

2024 Tax Season: Key Changes and Recent Court Cases Shaping Tax Law

Feb 5, 2025

Personal Tax

Corporate Tax

Wealth Planning

Accounting

Tax news

Sales Tax

Technology

Modern Axis

Corporate Tax

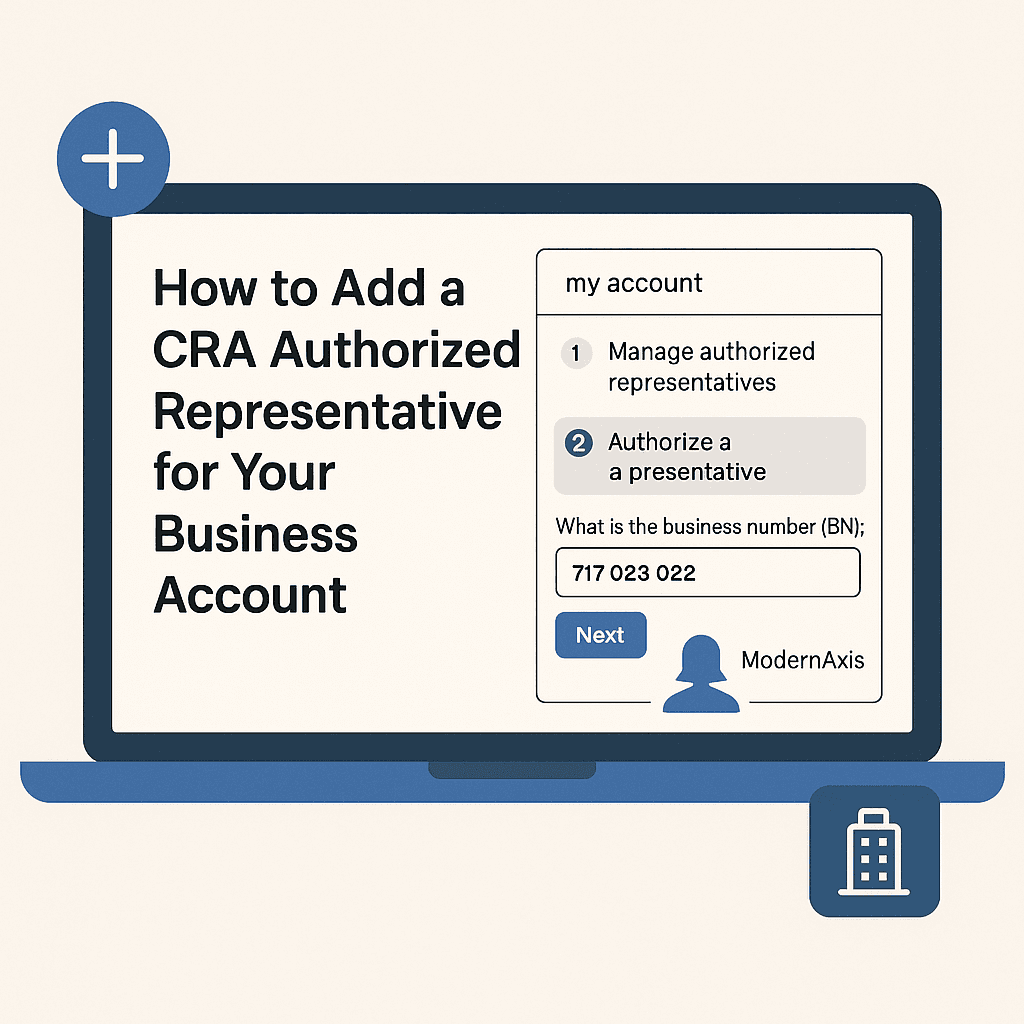

How to Add a CRA Authorized Representative for Your Business Account

Feb 1, 2026

Corporate Tax

Should You Incorporate Your Business?

Jan 25, 2026

Corporate Tax

What Are Tax Instalments in Canada?

Jan 16, 2026

Wealth Planning

The New BC Investor Playbook for Vancouver Island

Jan 14, 2026

Corporate Tax

What Is the Small Business Deduction?

Jan 4, 2026

Personal Tax

Personal Income Tax in Canada: Guide to Income and Deductions

Dec 15, 2025

US Tax

Understanding FBAR

Oct 16, 2025

Corporate Tax

CRA Voluntary Disclosures Program (VDP)

Oct 8, 2025

US Tax

Streamlined Filing for US Taxes

Sep 20, 2025

Modern Axis

CPA vs. Non-CPA: Why Choosing a Chartered Professional Accountant Counts

Sep 19, 2025

Personal Tax

5 Legal Income Splitting Strategies in Canada to Save Tax

Aug 24, 2025

Corporate Tax

Associated Corporations

Aug 23, 2025

Corporate Tax

Related Persons

Aug 4, 2025

US Tax

Understanding the Bona Fide Residence Test

Jul 11, 2025

US Tax

Understanding the Physical Presence Test

Jul 10, 2025

US Tax

US Tax Obligations for Americans Abroad

Jul 6, 2025

US Tax

U.S. Cross-Border Tax Services for Individuals

Jun 29, 2025

Wealth Planning

Lifetime Capital Gains Exemption

Jun 27, 2025

Wealth Planning

Why Family Trusts Still Matter: Legacy, Tax Efficiency & Asset Control

Jun 22, 2025

Tax News

CRA Stopping Paper Mail for Businesses in 2025

Jun 11, 2025

Modern Axis

Modern Axis Accounting: Redefining Accounting, Tax and beyond in Victoria, British Columbia

Jun 11, 2025

Sales Tax

GST on Short-Term Rental Property Sales and Change of Use

Apr 12, 2025

Corporate Tax

Holding Companies in Canada: Tax Benefits & When You Need One

Mar 8, 2025

Corporate Tax

Salary vs. Dividends: How to Pay Yourself as a Business Owner?

Mar 8, 2025

Personal Tax

Tax Considerations for Immigrants

Feb 28, 2025

Personal Tax

Understanding Tax Residency in Canada:

Feb 28, 2025

Personal Tax

Allowable Rental Expenses in Canada

Feb 16, 2025

Personal Tax

Can You Claim a Non-Resident Spouse as a Dependant in Canada?

Feb 16, 2025

Business Accounting

Bookkeeping Basics for Small Business Owners: How to Stay Organized and Help Your Accountant

Feb 5, 2025

Tax News

2024 Tax Season: Key Changes and Recent Court Cases Shaping Tax Law

Feb 5, 2025

Personal Tax

Corporate Tax

Wealth Planning

Accounting

Tax news

Sales Tax

Technology

Modern Axis

Corporate Tax

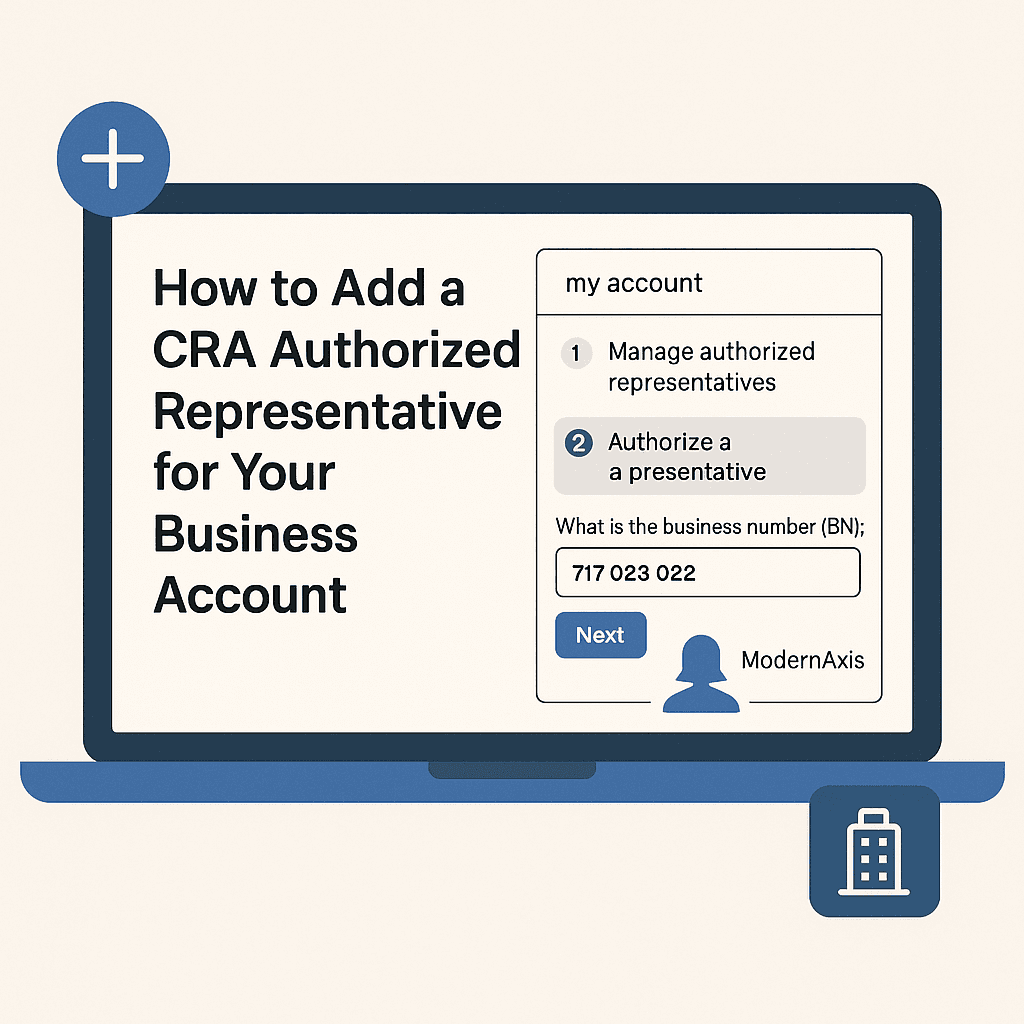

How to Add a CRA Authorized Representative for Your Business Account

Feb 1, 2026

Corporate Tax

Should You Incorporate Your Business?

Jan 25, 2026

Corporate Tax

What Are Tax Instalments in Canada?

Jan 16, 2026

Wealth Planning

The New BC Investor Playbook for Vancouver Island

Jan 14, 2026

Corporate Tax

What Is the Small Business Deduction?

Jan 4, 2026

Personal Tax

Personal Income Tax in Canada: Guide to Income and Deductions

Dec 15, 2025

US Tax

Understanding FBAR

Oct 16, 2025

Corporate Tax

CRA Voluntary Disclosures Program (VDP)

Oct 8, 2025

US Tax

Streamlined Filing for US Taxes

Sep 20, 2025

Modern Axis

CPA vs. Non-CPA: Why Choosing a Chartered Professional Accountant Counts

Sep 19, 2025

Personal Tax

5 Legal Income Splitting Strategies in Canada to Save Tax

Aug 24, 2025

Corporate Tax

Associated Corporations

Aug 23, 2025

Corporate Tax

Related Persons

Aug 4, 2025

US Tax

Understanding the Bona Fide Residence Test

Jul 11, 2025

US Tax

Understanding the Physical Presence Test

Jul 10, 2025

US Tax

US Tax Obligations for Americans Abroad

Jul 6, 2025

US Tax

U.S. Cross-Border Tax Services for Individuals

Jun 29, 2025

Wealth Planning

Lifetime Capital Gains Exemption

Jun 27, 2025

Wealth Planning

Why Family Trusts Still Matter: Legacy, Tax Efficiency & Asset Control

Jun 22, 2025

Tax News

CRA Stopping Paper Mail for Businesses in 2025

Jun 11, 2025

Modern Axis

Modern Axis Accounting: Redefining Accounting, Tax and beyond in Victoria, British Columbia

Jun 11, 2025

Sales Tax

GST on Short-Term Rental Property Sales and Change of Use

Apr 12, 2025

Corporate Tax

Holding Companies in Canada: Tax Benefits & When You Need One

Mar 8, 2025

Corporate Tax

Salary vs. Dividends: How to Pay Yourself as a Business Owner?

Mar 8, 2025

Personal Tax

Tax Considerations for Immigrants

Feb 28, 2025

Personal Tax

Understanding Tax Residency in Canada:

Feb 28, 2025

Personal Tax

Allowable Rental Expenses in Canada

Feb 16, 2025

Personal Tax

Can You Claim a Non-Resident Spouse as a Dependant in Canada?

Feb 16, 2025

Business Accounting

Bookkeeping Basics for Small Business Owners: How to Stay Organized and Help Your Accountant

Feb 5, 2025

Tax News

2024 Tax Season: Key Changes and Recent Court Cases Shaping Tax Law

Feb 5, 2025

MODERN

AXIS

CPA

Services

Contact

© modernaxis.ca - all rights reserved

privacy

MODERN

AXIS

CPA

Services

Contact

© modernaxis.ca - all rights reserved

privacy